The announcement of AMD acquiring Xilinx for $35 billion has sent shockwaves through the tech industry. This is a huge move for AMD, and it will have major implications for the future of computing. Here’s what we know so far about this acquisition.

Who is Xilinx and what do they do?

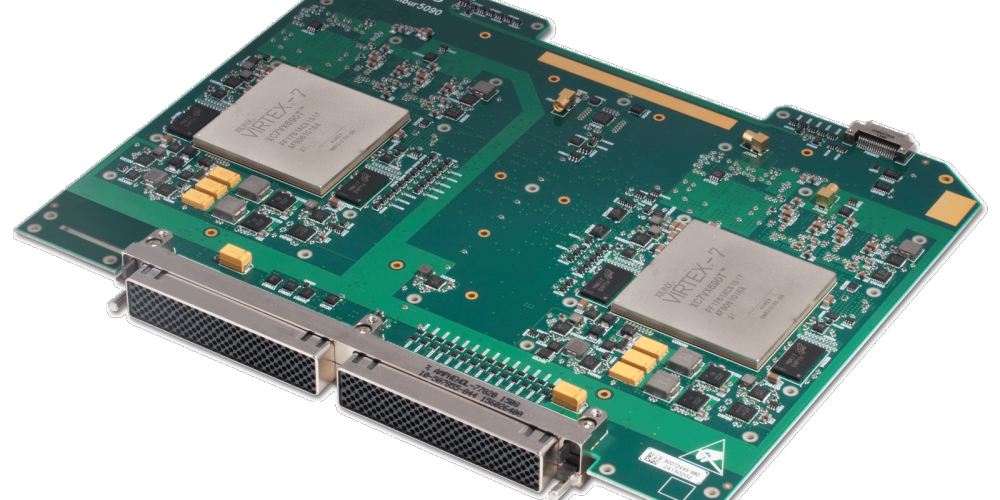

Xilinx Inc. is an American technology company that designs and manufactures programmable logic devices. It has revolutionized the semiconductor industry by introducing field programmable gate array (FPGA) technology which are chips that can be reprogrammed after they have been manufactured. This technology has enabled Xilinx to become one of the leading providers of silicon technology and Intellectual Property (IP). In November 2020 amd announced that it was acquiring Xilinx in a deal worth $35 billion, which values each Xilinx share at about $143, a more than 50% premium over where shares were traded prior to the deal. amd’s acquisition will bring together two complementary technologies amd’s computing and graphics processing units (GPUs) with Xilinx’s FPGAs to deliver one of the most complete portfolio’s of computing products for data centers and hundreds of customers in communications, AI/ML, automotive, industrial, aerospace, etc. amd and Xilinx now look forward to combining amd’s high-performance platforms with Xilinx’s Adaptive Compute Acceleration Platform (ACAP)to deliver unprecedented capabilities as far into 2021 and beyond are concerned!

What does this acquisition mean for the future of AMD and Xilinx products?

The acquisition of Xilinx by AMD is an unprecedented move, signaling the dawn of a new era in semiconductor technology. This hotly-anticipated merger will likely cause seismic changes to both product lines, as AMD and Xilinx draw inspiration from each other’s innovative IP portfolios. AMD’s massive amount of processing power and computing capabilities combined with Xilinx’s leading FPGA and programmable logic expertise could possibly lead to breakthrough system designs with even further optimized power consumption. As a result, developers can expect both product lines to feature fewer restrictions on design possibilities due to their easier programming interface, allowing them to create more innovative and optimized hardware solutions than ever before. Ultimately, AMD’s acquisition of Xilinx marks the start of an extraordinary journey for both companies which could potentially revolutionize the world of semiconductors.

How will this affect the competition between AMD and NVIDIA in the market share battle for GPUs and other chipsets used in data centers and gaming consoles?

With the recent acquisition of Xilinx by AMD, the battle for market share between AMD and NVIDIA in the GPU and other chip markets will surely intensify. With Xilinx’s portfolio of adaptive computing products, which includes a range of programmable logic chipsets that are used extensively in data centres and gaming consoles, amd now has an extra foothold in the competition for high performance access for these devices. As such, amd is expected to increase it’s market share and could even surpass nvidia in the process. It is yet to be seen how much this acquisition would affect amd’s overall presence, but it is certainly worth watching out for.

What does this mean for the prices of these products going forward, given that there will now be less competition in the market place between these two companies ?

The news of AMD’s acquisiiton of Xilinx certainly presents an interesting situation for customers. In the past, these two companies have been fierce rivals in the market place, competing fiercely against each other to provide the best quality products at reasonable prices. Now that they are merging, it remains to be seen how this shift will affect the prices of their respective offerings. Some analysts believe that the lack of competition between these two companies could potentially lead to price hikes as they attempt to maximize profits. However, with both organizations offering cutting-edge solutions and powerful features, it is possible that customers may still receive quality products at competitive prices even with less competition in the market place.

How will current shareholders of both companies be affected by this acquisition ?

The acquisition of Xilinx by AMD is undoubtedly a win-win situation for both companies and their shareholders. Current shareholders of AMD will benefit from owning a larger, more diversified company and the added growth opportunities that come from this acquisition. For shareholders of Xilinx, the deal will bring new access to additional resources with improved technology to back it up and help strengthen the businesses of both companies. All in all, these gains promise increased profits for both sets of current shareholders in the near future and beyond.

As the data center and gaming industries continue to grow, it will be interesting to see how this acquisition affects the competition between AMD and NVIDIA. With less competition in the marketplace, prices for GPUs and other chipsets could rise. However, given the immense growth potential in these industries, shareholders of both companies are likely to benefit from this acquisition long term. What do you think about this acquisition? How do you think it will affect the competitive landscape between AMD and NVIDIA? Let us know your thoughts in the comments below.